ISSN 2410-5708 / e-ISSN 2313-7215

Year 13 | No. 36 | February - May 2024

© Copyright (2024). National Autonomous University of Nicaragua, Managua.

This document is under a Creative Commons

Attribution-NonCommercial-NoDerivs 4.0 International licence.

Analysis of Tax Revenue Collection period 2007-2020

https://doi.org/10.5377/rtu.v13i36.17628

Submitted on August 02nd, 2023 / Accepted January 16th, 2024

Jorge Luis Ponce Gutiérrez

General Directorate of Revenue, Nicaragua

Erika Janeth Navarrete Mendoza

National Autonomous University of Nicaragua, Managua

Section: Social sciences, Business education and Law

Scientific research article

Keywords: Tax revenues, Tax Policy, Tax Pressure, Tax Collection, Progressive System, Tax System, Regressive System.

Abstract

The main objective of this research is to analyze Nicaragua’s public finances, focusing on tax revenue collection, and to verify that the Nicaraguan tax system has undergone significant changes with the implementation of tax policies, i.e., to reduce the regressivity gap and move towards a more progressive, fair and equitable system in fiscal terms.

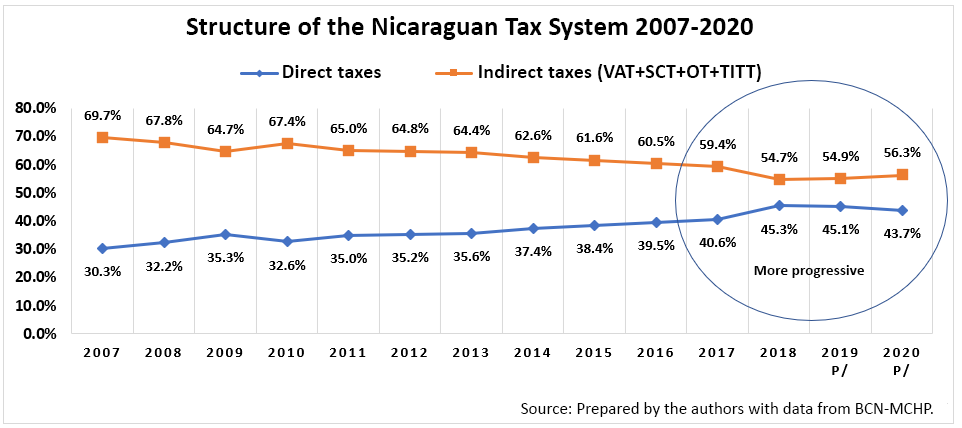

The regressivity gap of the Nicaraguan tax system has decreased notably in the last 14 years, the regressivity for the year 2007 was 69.7% in the course of the time series of collection analyzed it was determined that for the year 2020, the regressivity is 56.3%, it means the fiscal policy of reducing the tax burden in indirect taxes has had notable effects while the progressivity of the system is significantly visible since more wealth is being taxed, for the year 2007 the progressivity was 30.3% and in the year 2020, it was 43.7%. It should be noted that the growing evolution of tax revenue collection has allowed these changes in the tax collection system to be notable in fiscal matters.

Introduction

The objective of this research is to evaluate the possible collection effects of tax revenues through the analysis of direct taxes (IR) and indirect taxes (VAT, SCT), analyzing their structure in the tax system and through the tax pressure that quantifies or measures the amount of money in taxes that taxpayers pay to the State in comparison with the gross domestic product (GDP).

To quantify Nicaragua’s tax collection, we used the Central Government’s tax collection statistic database through a 13-year time series to analyze the behavior and evolution of tax collection, and the changes that have been implemented in tax policy towards a more progressive tax system.

The collection structure of the tax system has closed the gap of regressivity, through the tax policy oriented to have a fairer and more equitable tax collection system.

Material and Method

Nicaragua’s tax collection was quantified using the statistical database of tax collection of the Central Government, and to quantify the tax burden, the statistical base of the real sector was used to quantify the current GDP.

This information was used to construct a 13-year time series to analyze the behavior and evolution of tax collection, and the changes that have been implemented in tax policy towards a more progressive tax system.

To determine the structure of the Nicaraguan tax system, we proceeded to identify how taxes in Nicaragua are classified according to their collection nature:

Structure of the Nicaraguan Tax System

|

Direct Taxes |

|

Income Tax (IR) |

|

Indirect Taxes |

|

Value Added Tax (VAT) |

|

Selective Consumption Tax (SCT) |

|

Other taxes |

|

Taxes on international trade and transactions |

|

TS: Tax System (Direct and Indirect Taxes) |

|

RTS: Regressive Tax System (Taxes consumption) |

|

PTS: Progressive Tax System (Taxes Wealth) |

To determine the calculation of Nicaragua’s total tax revenues, the following equation is used:

TIT: IT + VAT + SCT +OI+ TITT

Where:

TTR: Total, Tax Revenues

IT: Income Tax (IR)

VAT: Value Added Tax (VAT):

SCT: Selective consumption tax (SCT)

OT: Other taxes

TITT: Taxes on international trade and transactions.

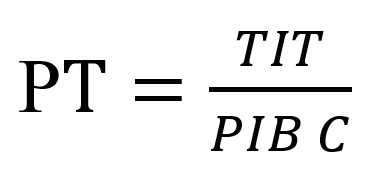

To quantify the tax burden, two variables are taken into account: TTR and GDP C, and it is determined through the following equation:

Where:

PT: Tax Pressure

TIT: Total Tax Revenues

C GDP: Current GDP

Nicaraguan Tax System

To analyze tax revenues, it is necessary to know the behavior of tax collection over time. For this purpose, this research analyzes the time series from 2007 to 2020, the period considered in the study.

The Nicaraguan Tax System is made up of laws and resolutions issued by the National Assembly. The tax structure consists mainly of Income Tax (IT), Value Added Tax (VAT), Selective Consumption Tax (SCT), and Import Tariff Duty (ITD).

To know the evolution of tax revenues in Nicaragua, we must know concretely what the behavior of the Nicaraguan tax system has been, and what has been the tax policy that has been implemented during the last few years.

The tax policy of the Nicaraguan government is characterized by a high degree of concentration in a few taxes, and with a regressive tendency. Regressivity is evidenced when the tax rate experiences a decreasing amount as the income of economic agents increases.

Value-added tax (VAT) on basic goods is a regressive tax because it affects consumers to a greater extent. Income tax (IT) is the tax levied on all remuneration to productive factors and income from Nicaraguan sources obtained by resident and non-resident taxpayers, from labor income, economic activities, capital, and capital gains and losses.

Value-added tax (VAT) is levied on the sale of goods, provision of services, and imports. There is a general rate in the country of 15 percent. Exports are the only goods taxed at the 0 percent rate. There is also a 7 percent rate on household electricity consumption of more than 300 and less than 1000 KWH.

The selective consumption tax (SCT) affects the value of sales and imports of goods. It mainly affects goods considered to be luxury goods and those of the tax industry. Import duties (ITD) are a specific tax incurred at the time of importing goods into the customs territory.

The stamp tax (ST) is a tax levied on certain documents, provided they are issued in Nicaragua or are issued abroad but are effective in the country. Finally, the sovereign tax was created by presidential decree in 2000 and is levied on goods and services of Honduran and Colombian origin.

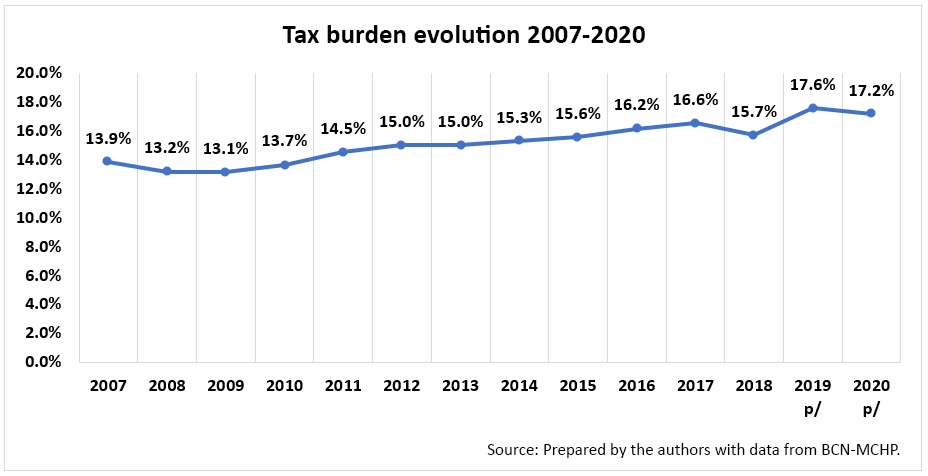

Nicaragua has made significant progress in tax matters, presenting a 13.7% growth concerning the gross domestic product (GDP) in 2010, while for the year 2020, the increase in tax revenues concerning GDP was 17.2%.

It should be noted that these great advances in tax revenue collection are due to the efforts of the General Directorate of Revenue (DGI as in Spanish) and the General Directorate of Customs Services (DGA as in Spanish) to guarantee the necessary resources to cover the expenditures of the general budget of the Republic of Nicaragua.

The recent tax reforms that have been presented in Nicaragua’s tax system with the country’s tax laws, such as the Tax Equity Law (LEF as in Spanish) and its reforms, and then at the end of 2012 the Tax Concertation Law (LCT as in Spanish). They have allowed improving economic policies to have better collection rates in the country by taxing income that was not taxed before.

Tax Revenues

The collection of tax revenues is of vital importance to cover public expenditures (current and capital expenditures) of the Nicaraguan government, since they represent 90% of total revenues. Tax revenues in Nicaragua are structured as follows:

Direct Taxes:

• Income Tax IT. E.A (Economic Activities).

• Income Tax IT. (Capital Income, Labor Income).

Indirect Taxes:

• Value Added Tax VAT (Import - Internal).

• Selective Consumption Tax (imports, petroleum derivatives, fiscal industries (soft drinks, beer, rum).

• Import Tariff Duties ITD.

Results and Analysis

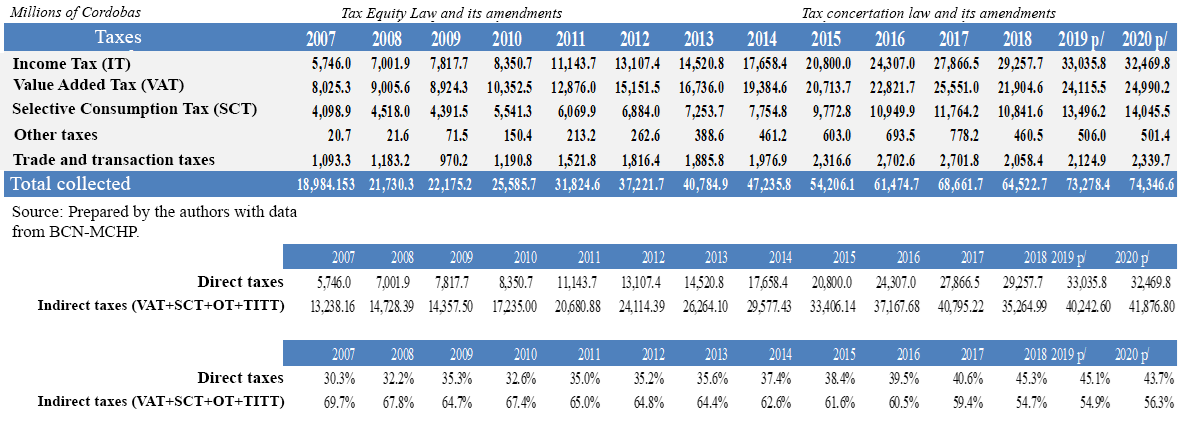

This section presents the main results of this research on the Analysis of Tax Revenue Collection for the period 2007 - 2020. The general findings related to tax revenue collection in Nicaragua and its evolutionary dynamic are presented to quantify the efficiency of the government policy through the fiscal policy which is intended to reduce the regressivity gap of the tax system, making it a more progressive system. That is why all the results presented will be more aggregated and somewhat general data.

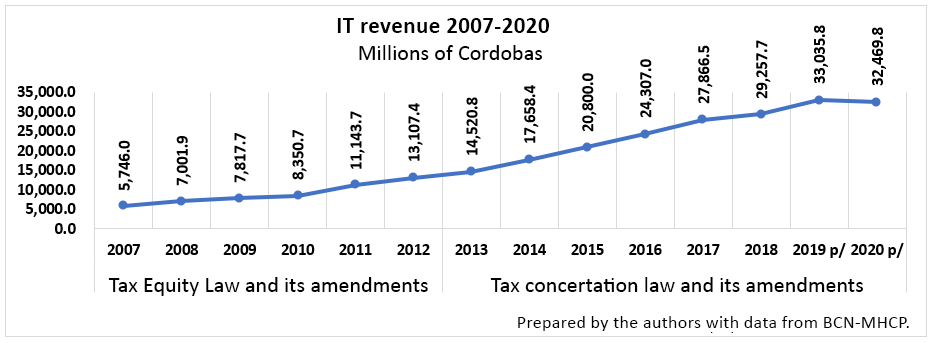

Analyzing the results of tax collection, it is observed that tax collection through income tax (IT), for the year 2007 represented 30.3% of total tax revenues, if it is considered that total tax revenues represented 18,984.15 million córdobas this suggests that the total revenue operated through IT in absolute terms was 5,746.0 million cordobas.

Nicaragua’s tax policy focused on taxing wealth through IT, it can be seen that the collection of this tax registered a growing trend from 2013 to 2020, this is fiscal terms to the change of tax legislation by repealing Law N°453 “Tax Equity Law” (LEF, 2003), and its reforms in 2005 (RELEF) and 2010 (RERELEF) and the implementation of Law N°822 “Tax Concertation Law (TCL) in 2013”. (See Graph 1).

Graph 1: Revenue of Income Tax 2007-2020

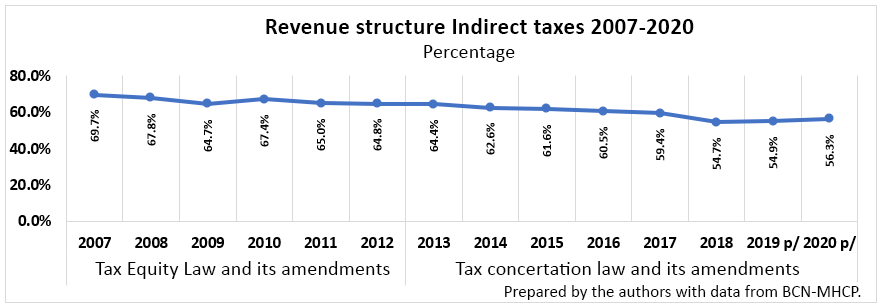

Graph 2 reveals that in 2007, 69.7% of tax revenues originated from indirect taxes, i.e. those levied on consumption when applied on most of the purchases/sales and services rendered, we are referring to VAT, SCT, and ITD, in absolute terms this represented 13,238.16 million cordobas.

Graph 2. Structure of Indirect Tax Collection (VAT+SCT+OI+SCTETI) 2007-2020

With the implementation of a government policy focused on a tax policy towards a less regressive system, the behavior of indirect taxes during 2008-2020 has registered a less regressive trend as shown in Graph 2, in the year 2020 56.3% of the total tax revenues are coming from indirect taxes (See table 1).

Table 1. Tax Revenue Collection 2007-2020

Towards a more Progressive Tax System

According to the results obtained, it can be observed that the implementation of a government policy aimed at taxing more wealth and decreasing the regressivity (taxing less consumption) of the Nicaraguan tax system, can be observed in Graph 3, which shows that the regressivity gap has decreased relatively in 2007, 69.7% of total tax revenues that were indirect taxes and 30.3% direct taxes.

In the time series of 13 years from 2007 to 2020 it is observed that the gap has gradually decreased from 2013 to 2020, this means that the implementation of Law No. 822 in 2013 has allowed meeting the objectives of tax policy in making a change in the tax system from regressive to progressive, making it a fairer and more equitable system.

Graph 3: Structure of the Nicaraguan Tax System 2007-2020

Tax burden

Macroeconomic theory indicates that the government’s tax burden is the quotient of dividing the total tax revenue (TTR) collected by the government by the value of the gross domestic product in current terms (GDP C) (TIT/GDP C). For the year 2007, the tax burden represented 13.9% of Nicaragua’s gross domestic product (GDP) (See Graph 4). It is important to emphasize that according to international studies, since 2008 Nicaragua has been improving its tax collection capacity concerning GDP, as a result of two important factors: on the one hand, a more dynamic economic growth rate and on the other hand, a more efficient tax policy.

Graph 4: Evolution of the Tax Burden 2007-2020

However, it should be noted that the level of tax pressure must strike a balance between the government’s budgetary needs and the imperative of robust GDP growth. For example, if the tax rate were 100%, the central government’s tax burden, i.e., the quotient of dividing the total taxes (TIT) collected by the central government by the Gross Domestic Product (GDP), would be 0%, and the state’s tax revenues would be equal to zero.

At the other extreme, if the tax burden were 100%, the state’s tax revenue would also be zero because no one would work for nothing. Therefore, is the premise that a high tax burden discourages economic growth and lowering the tax burden could increase taxes on the state true? Or, by reducing taxes, would economic growth accelerate, there would be more employment, the taxpayer base would increase, consumption would grow and tax revenues would rise?

The above question highlights the need for decision-makers to have adequate knowledge of the interdependence of these variables, since excessive tax pressure could discourage domestic and foreign investment and, as a consequence, could lead to a fall in GDP and, therefore, a reduction in central government revenues.

Conclusions

This article analyzed the collection of tax revenues during the period 2007-2020, by determining the tax burden, and the collection share of direct and indirect taxes.

The dynamic of gross domestic product (GDP) growth is closely related to the growth of tax collection. It should be noted that the years in tax revenue collection and economic growth recorded a decrease for the year 2018 due to the socio-political situation of the country as a result of the pandemic. However, the collection dynamic has had a positive evolution with the implementation of tax policies focused on reducing regressivity.

Direct taxes (IT) in 2007 represented 30.3% of total tax revenues and have had an increasing trend from 2008 to 2020, in 2020 direct taxes represented 43.7% of total tax revenues, relatively decreasing the regressivity gap.

In the case of indirect taxes (VAT, SCT, other taxes) in 2007, they represented 69% of tax revenues total and had an opposite behavior to that of direct tax since its behavior has been decreasing, this means that the Nicaraguan tax system has decreased regressivity and has become more progressive, i.e. taxing wealth. It must be made clear that tax collection has not had growth problems, what has happened is that the tax system’s collection structure has closed the regressivity gap, through a tax policy aimed at having a fairer and more equitable collection system.

Works Cited

Artana, D. “Evaluación Reciente de la Recaudación Tributaria, Gastos Fiscales y Proyecciones Fiscales”. (2005).

Báez, Julio y Báez Teódulo. “Todo Sobre Impuestos en Nicaragua”. 7ª Edición- Managua (2007).

Banco Central de Nicaragua Informe Anual 2010-2020.

Canales J., Soto U. y Chavarría A. 2009. ‘‘Revisión e incorporación del Gasto Tributario en El Presupuesto General de La República’’.Centro Regional de Asistencia Técnica de Centroamérica, Panamá y República

CEPAL, Villela L., Lemgruber A. Y Jorratt M. 2009. ‘‘Los Presupuestos de Gastos Tributarios’’.

CEPAL. Jiménez JP., Sabaini J C. Y Podesta A.2009 ‘‘Equidad y Evasión en América Latina.

Jorrat (2012). “Medición de Gasto Tributario: Informe de Asistencia Técnica”. Dominicana.

Mann, A. Y Burke R. ‘‘El Gasto Tributario en Guatemala, 2002’’.

Ministerio de Economía y Finanzas Públicas. “Estimación de los Gastos Tributarios para los años 2009 a 2011”. Preparado por la Dirección Nacional de Investigaciones y Análisis Fiscal.” (2012).

Ministerio de Economía Y Finanzas. ‘‘Estimación de Los Gastos Tributarios para los años 2008 a 2009’’. Argentina.

Ministerio de Hacienda de República dominicana. “Gastos Tributarios en República Dominicana: Estimación para el Presupuesto General del Estado del año 2013. Comisión Interinstitucional Coordinada por la Dirección de Política y Legislación Tributaria (2012).

Ministerio de Hacienda y Crédito Público de Nicaragua Comprendido Estadístico de las finanzas públicas de Nicaragua 2000-2012.

Ministerio de Hacienda y Crédito Público de Nicaragua. “El Gasto Tributario en Nicaragua”. Preparado por Julio Cardoza para el MHCP en el marco del Programa de Fortalecimiento de la Preparación Fiscal del BID (2010).

OCDE (Organización para la Cooperación y el Desarrollo Económico) (2001), “Measuring Capital-OECD Manual”.

Servicio de Impuestos Internos Chile. “Estimación de la Evasión en el Impuesto a la Renta de las Empresas Serie 2009-2009” (2012).

SIMONIT S. 2001. ‘‘Los Gastos Tributarios y Las Renuncias Tributarias en América Latina’’

Superintendencia de Administración Tributaria. ‘‘Estimación del Gasto Tributario del Gobierno Central, 2005 y 2006’’. BARRA P.Guatemala.

Vallecio R. 2005. ‘‘Estudio y Análisis de Sacrificio Fiscal En Nicaragua.

Villela, Luiz, Andrea Lemgruber y Michael Jorrat. “Gastos Tributarios: La Reforma Pendiente”